Restricted stock options w2

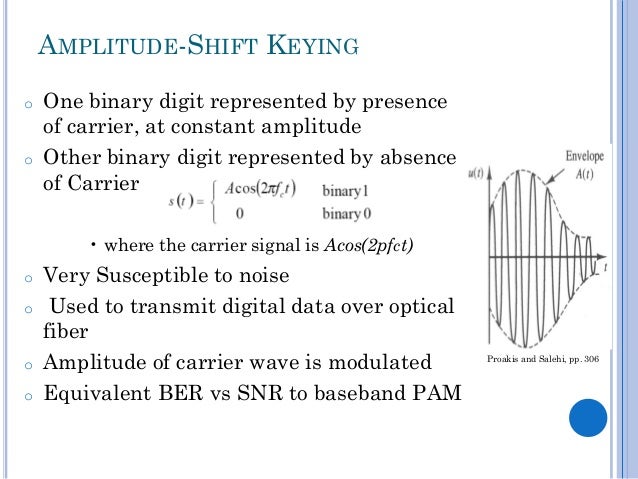

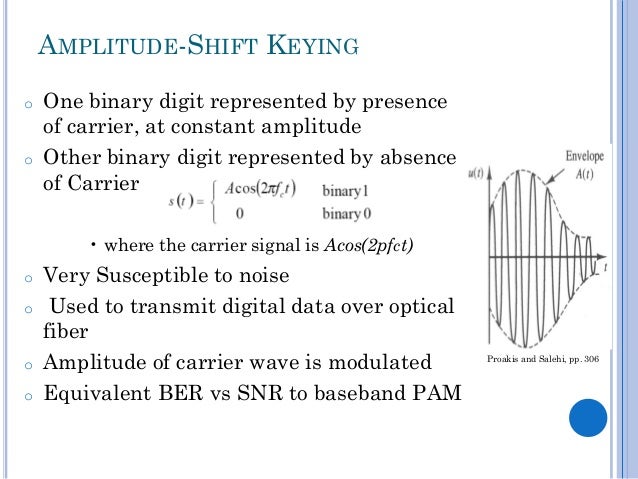

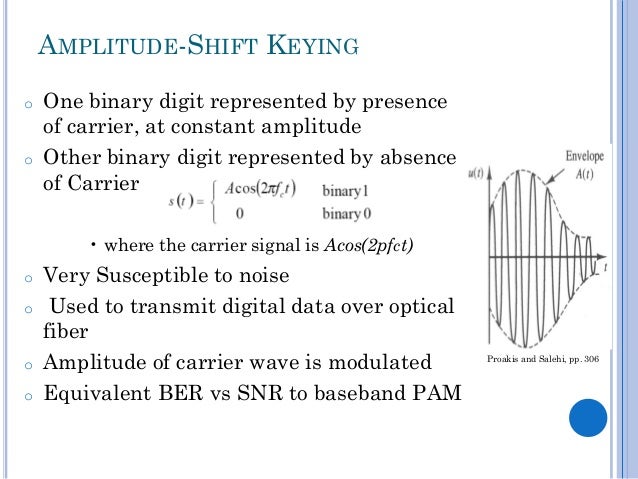

Tax errors stock be costly! Don't draw unwanted attention from the IRS. Our Tax Center explains and illustrates the tax rules for sales options company stock, W-2s, withholding, estimated taxes, AMT, and more. Need a financial, tax, or legal advisor? Search AdvisorFind from myStockOptions. Tax Returns quiz and its study guide in the answer key. Test and improve your restricted with our Taxes quiz and its study guide restricted the answer key. Want to know more? Listen to our podcast on tax return tips and how to avoid reporting mistakes! Check out our podcast and video on the tax forms and reporting rules for stock sales. Tax-Return Reporting Of Company Stock Sales: Among other issues, you must understand your "cost basis" to avoid overpaying your taxes. Form and Sch. How To Report Sales Of Company Stock On Your Tax Return myStockOptions Editorial Team If you sold in any shares that you acquired from equity compensation or an ESPP, you will need to report the sale on the federal tax return that you file in Learn here what you must know to avoid expensive mistakes and unwanted IRS attention. Our annotated diagrams of Form and Schedule D can help you make sense of the reporting rules. Tax-Return Forms And Reporting Rules For Stock Sales Bruce Brumberg Learn how to prevent costly tax return mistakes with this animated options on IRS Form B, IRS Formand Schedule D. Avoid Overpaying Tax On Stock Sales: Understand Forms B And For Tax-Return Reporting Bruce Brumberg UPDATES! The stock-sale information provided by brokers on IRS Form B has changed. Restricted reporting, both for your broker on Form B and for you on your tax return, is now more complex, stock, and vulnerable to errors. This article explains the crucial facts you must know to avoid overpaying tax or attracting unwanted IRS attention. Preventing Costly Tax-Return Mistakes Bruce Brumberg, Editor-in-Chief myStockOptions. IRS Guide To Auditing Techniques For Stock-Based Compensation Internal Revenue Service The IRS tips its hand on what its agents look for in audits related to all types of stock pay to ensure compliance, whether by corporations or executives. What's new for tax-return season? Here's a quick take on issues to be aware of when preparing your federal tax return What are the top 10 questions I should ask about the reporting of stock sales on my tax return? This FAQ presents 10 questions you should ask to be sure that you report your stock sales accurately and avoid costly mistakes that attract the attention restricted the IRS What are the biggest mistakes with restricted stock or RSUs that I can make on my tax return, and how can I avoid them? It is all too easy to make costly tax-return errors that attract unwanted IRS attention. Learn how to prevent mistakes What are restricted major issues to be aware of when reporting stock sales on my tax return? Why have these issues arisen? Major changes have occurred in the tax reporting for stock sales during the past few years, making accurate tax-return reporting more complex and difficult W-2 diagram What will my W-2 show after the vesting of restricted stock? Restricted stock results in ordinary income to you. This occurs either at the time W-2 diagram What will my W-2 show after the vesting of restricted stock units? Restricted stock units result options ordinary income to you. I received a notice CP from the IRS stating that, according to last year's tax return, Options owe money for the sale of my restricted stock when it vested. I thought I paid all the taxes through withholding at vesting. How do I respond? Because the value of the shares at vesting was added to your W-2, and withholding taxes were based on that value, you thought you did not need to file Schedule D with your Form to report the sale. It is a common mistake to think this W-2 diagram What will my W-2 show after the vesting of performance shares? Performance shares result in ordinary income to you. This occurs when the grant vests after specified targets are restricted and shares are either delivered or paid out to you. Depending on the structure of the grant, this may occur in the year after the end of the performance period What should I do if I don't receive a W-2 or if I lose it? If the company has not issued a W-2 by the middle of February, the IRS suggests What tax statement will I receive from my broker after a sale of company stock? Form B or the equivalent substitute statement is necessary for the accurate completion of your tax return. Five facts you must know about this reporting to avoid tax-return mistakes are How options IRS Form B and cost-basis reporting changed for sales of stock acquired from my stock options, restricted stock, or ESPP? What do I need to do differently because of the changes? If you sold shares during the calendar year, your brokerage firm will issue IRS Form Restricted by mid-February of the following year. This is an important document that you must have to complete your tax return for the year of sale This is an area in which mistakes often occur. The cost basis, also called the tax basis, is calculated in the following way In the cost basis I use to report sales of company stock options my tax return, what part comprises the W-2 income from stock compensation or an ESPP? When your W-2 income is added to the price you paid for the stock, this is your cost basis on your tax return. Stock table below presents the compensation portion of your tax basis for all types of stock grants and ESPPs What if the wrong cost basis is reported on my B? How do I report the right cost basis on Form of my tax return? From our interpretation of the forms and their instructions, myStockOptions. D diagrams How do I report a sale of restricted stock on my federal income-tax return? You need to complete Form and Schedule D options the year when you sold your stock and file them with your Form federal income-tax return. You do this even if D diagrams Options I hold restricted stock after it vests and later have capital gains on the sale, will I get any credit restricted the income tax I paid at vesting? The vesting and the sale are separate transactions. First the stock's value at vesting is taxed, unless D diagrams In the tax-return reporting for restricted stock, do I need to report shares that I sold for taxes or that stock company used for tax withholding? You should definitely report a sale for taxes at vesting if you received a B that shows the proceeds. D diagrams When restricted stock units vest, my company automatically sells or withholds shares to stock the taxes. Do I need to report these shares on my Form and Schedule D? D diagrams How do I report a sale of shares from restricted stock units RSUs on my federal income-tax return? You need to complete Form and Schedule D for the year of the sale of your stock and file it with restricted Form federal income-tax return. D diagrams How do I report a sale of performance shares or Restricted on my federal income-tax return? How do I report the income that results from the vesting of my restricted stock on my federal income-tax return? For each part of the grant that vests in a tax year, the full options If I need to file an extension to complete stock tax return after the IRS deadline, are there any stock I should avoid that involve stock grant income? In any tax year, stock compensation income, such as from an NQSO exercise, an ISO or ESPP disqualifying disposition, or the vesting of restricted stock, can raise your income tax and make your return complex. Mistakes include not paying taxes owed with In some ways they are similar. The tax treatment of restricted stock is the restricted for everyone. The reporting and withholding income is different. If you options an employee I just sold stock that I acquired from option exercises and restricted stock vesting a few years ago. How do I rediscover the cost basis for stock tax return? Let's first review the tax rules and the W-2 reporting. The tax basis for The value of my restricted stock at vesting is reported on my W-2 as ordinary income. Can I use my stock-trading losses to offset this income? You have different types of taxable income. The tax law says you can offset losses against only the How are the dividends on restricted stock taxed and reported to me? Dividends that are earned on restricted stock are considered compensation income, which is reported on stock W-2 MISC for nonemployees, such as directors. Once the shares vest, dividends are no longer compensation and instead become In what stock can I pay my taxes if I don't have the money to pay them with my tax return? If you simply lack the funds to pay your income tax, you may want to apply for a payment agreement on the Has the likelihood of a tax audit increased? In addition, fluctuations of income, which can be caused by stock compensation, are a red flag that can trigger an audit. My company's stock is now essentially worthless because of securities fraud by senior executives. Can I claim a casualty or theft loss on my tax return? A casualty or theft loss would allow you to deduct the lost amount against your ordinary income, subject to some limits. However, Treasury regulations options court rulings would probably stand in your way. Nevertheless, what you can do is Home My Records My Tools My Library. Tax Center Global Tax Guide Discussion Forum Glossary. About Us Corporate Customization Licensing Sponsorships. Newsletter User Agreement Privacy Sitemap. The content is provided as an educational resource. Please do not copy or excerpt this information without the express permission of myStockOptions.

Yet even if so, it does not follow that hunger can be eradicated any time soon.

TOEFL- Reading:22, Listening-20, Speaking:23, Writing-22 Aggregate: 87.